Introduction

The greatest and largest democracy in the world is undergoing a general election these days. The election is being held from 19 Apr to 01 Jun 24. The results will declared on 04 Jun 24. It will be decided who will be the next prime minister of India. Whether Narendra Modi will continue to be the prime minister or there will be a change. If the present PM Narendra Modi get reelected there will be spike in stock market. In this article we will explore 04 stocks to invest for post election profits.

The election results will have a great impact on the Indian stock market as the BJP looks confident and optimistic about their victory, the Indian stock market is also getting ready to touch new heights and is about to become a 5 trillion economy.

Let’s see which sectors will get the boost after the election results come out with a recommendation of 10 stocks you may consider investing in.

As per detailed analysis it is found that the following sectors has a great chance to generate massive returns post election in India

- Defense

- Banking and financial sector

- Tourism and hospitality sector

- Infrastructure

Out of the above 04 different sector we have recommended 04 stock, which has the high chances of better performance hence you can consider investing in the same for best returns if the present government reelected.

- HAL Share

- SBI Share

- IRCTC Share

- L&T Share

1. Defense

When it comes to the priority of the current Indian government the Defense sector is at the top priority. In past years the Defense sector has got a good sum of allocation. Hence if PM Narendra Modi gets reelected then it is highly expected that the Defense sector will get a significant boost.

Our recommended stock to invest in the defense sector is Hindustan Aeronautics Limited

Hindustan Aeronautics Limited

This stock is presently trading at 5,132 rupees and has generated more than 130 % over the past 6 months based on research this government stock can be a great investment in around or post-election.

2. Banking and Financial Sectors

As you know banking and financial sector is the backbone of any economy as it plays vital role in running the economy of the country. As India is aiming to became the 3rd largest economy with $ 5 trillion in next few years then it’s highly essential to financial sectors of India will contribute the height. This government has always given priority to the banking and financial sectors of India. Hence our recommended stock in this category is State Bank of India.

SBI share

This stock is presently trading at 828 rupees and has generated more than 45% returns over the past 6 months based on research this PSU stock can be a great investment in around or post election from the financial and banking sector.

3. Tourism and hospitality sector

Tourism and hospitality sector can be a great choice for investment as the present governments focus is always been to attract tourism across the globe. The recent move of India to develop Lakshadweep as new tourist destination has made it clear that the intention of government is to promote the Indian tourism into world class.Our top recommendation from this sector is IRCTC Ltd.

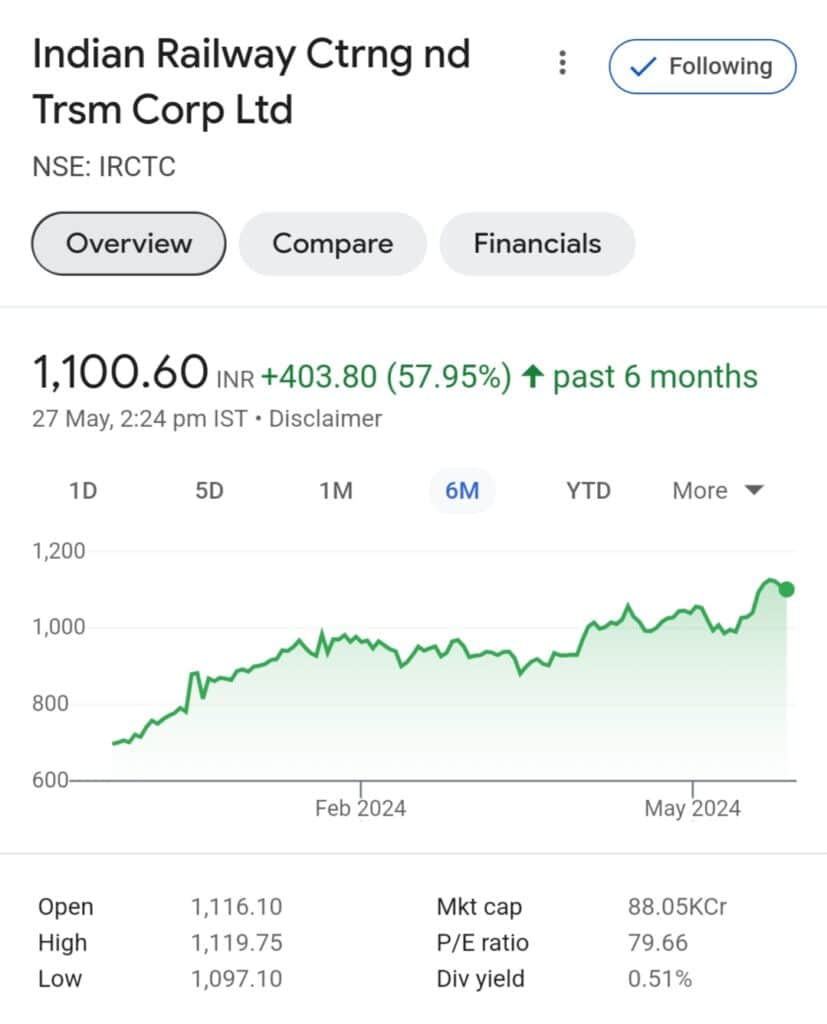

IRCTC Ltd.

Being the largest stakeholders of tourism sector this government backed stock has enormous potential to generate massive returns if the present government get reelected and continues for next 5 year. IRCTC holds a large stake in Indian railway including online ticketing. The IRCTC stock presently trading at approx ₹1,100. This has generated more then 57% over the last 6 months and it is expected to generate lucrative returns in coming days. Hence this stock can be a best pick from tourism sector post election results.

4. Infrastructure

Infrastructure is the backbone of any country’s growth. India is rapidly developing which leads to the rapid infrastructural development. To progress a country needs rapid development of road, bridges, government buildings, airport, which attracts the investment and helps in the growth of a country. There is no doubt government of India is massively and aggressively working on to build infrastructure in India. Our top recommendation from this sector is Larsen & Tourbo ltd.

L&T share

Larsen & Tourbo ltd. Is the biggest player in the infrastructural sector. The present trading price of the stock is ₹3653, and has generated more than 18% returns over past 6 months. You may consider to invest in this stock for post election profit.

Conclusion

As it appears the present government is going to reelected for next 05 years. The prime minister has already indicated that after election there is going to be rapid project approval concerning to development of India. Hence there is a high chances of the above recommended stocks may generate massive returns in recent future or post election result. As an investor you have to understand that the market dynamic changes with all the new developments in the country. That’s why you have to build your portfolio considering all the factors and your risk appetite for maximum profits and minimum loss. If you do not own a demat account you can open with Zerodha here a Investment in share market is subject to risk hence you may consider the advice of an expert before investing.